Next step in the UPI Revolution - 1 Click UPI

Introduction

1 Click UPI

It’s no surprise that UPI revolutionized India's digital payments landscape. What started as a simple method to transfer money to your friends and family is now synonymous with making payments anywhere and everywhere, literally.

Its adoption soared due to its user-friendly nature, fostering financial inclusion and reducing reliance on cash. UPI's success catalyzed a surge in digital transactions, transforming India into a cashless economy hub. With an experience that already seems so solid, what could be the next thing? Well -

1 Click UPI is a payment experience that allows users to seamlessly complete payments without moving to any other third party app, reducing friction with less clicks & time.

UPI clocked over 74 Billion transactions and INR 12,600 Crore in value in the year 2022 alone

The first form of digital payment can be traced back to the creation of the Diners Club card in 1950, in the States. Although it wasn't purely digital in the sense we think of today, it marked the beginning of electronic payment systems laying the groundwork for the development of modern card systems, which eventually evolved into the digital payment methods we use today.

How did we start?

Problems

User Journey

How did we get

to this journey?

Impact

So how does the journey start?

Onboarding

Pay Flow

What’s next for 1 Click UPI?

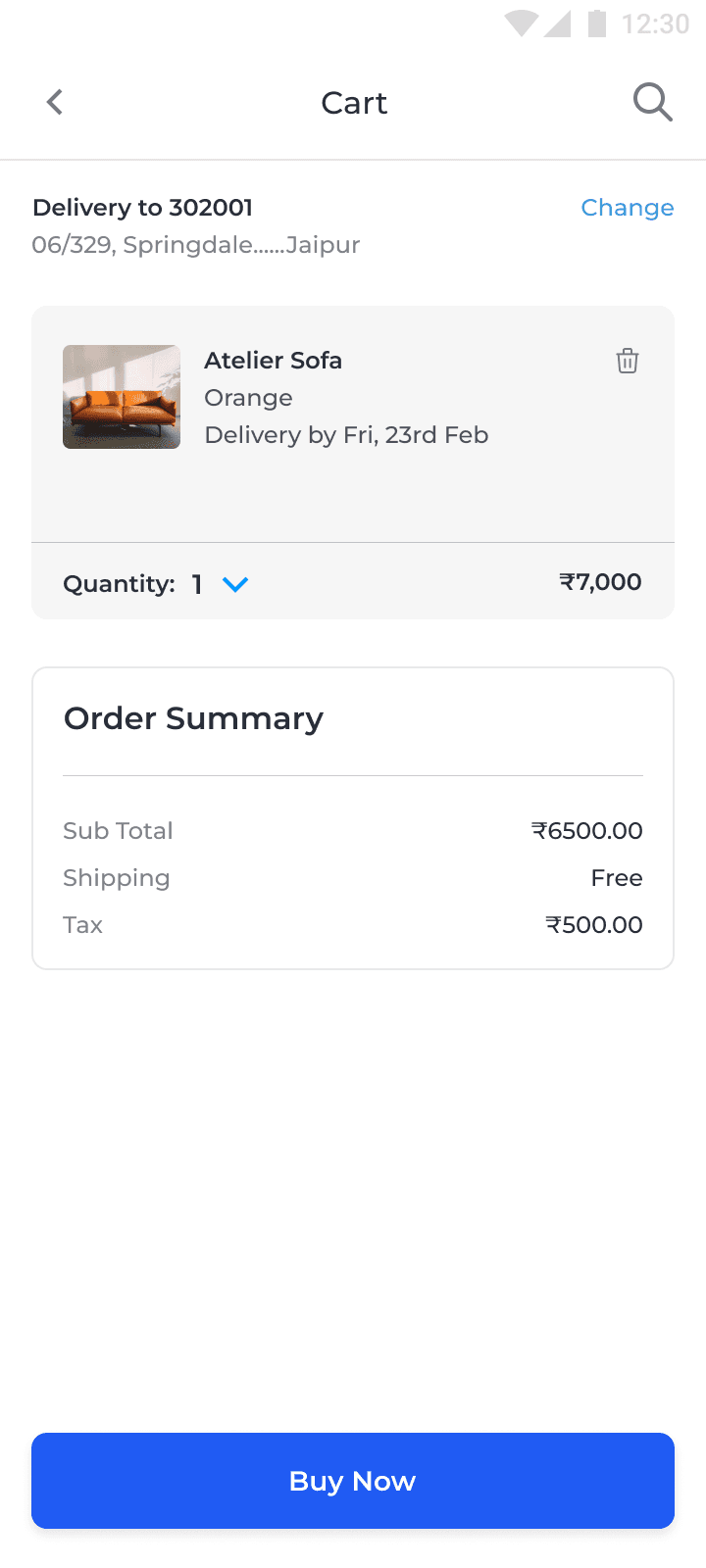

Currently, the most optimum UPI peer to merchant checkout experience is called UPI Intent. A happy user journey looks something like this -

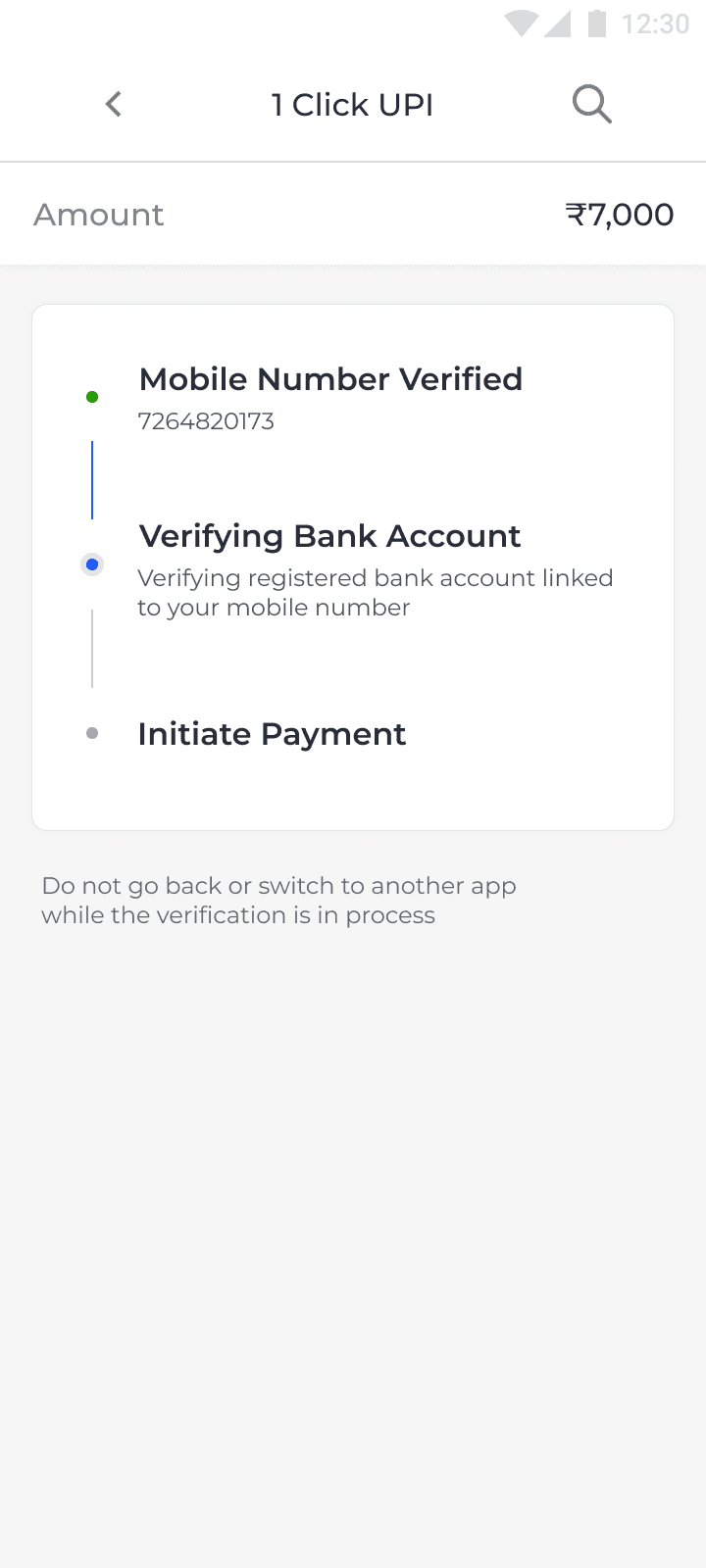

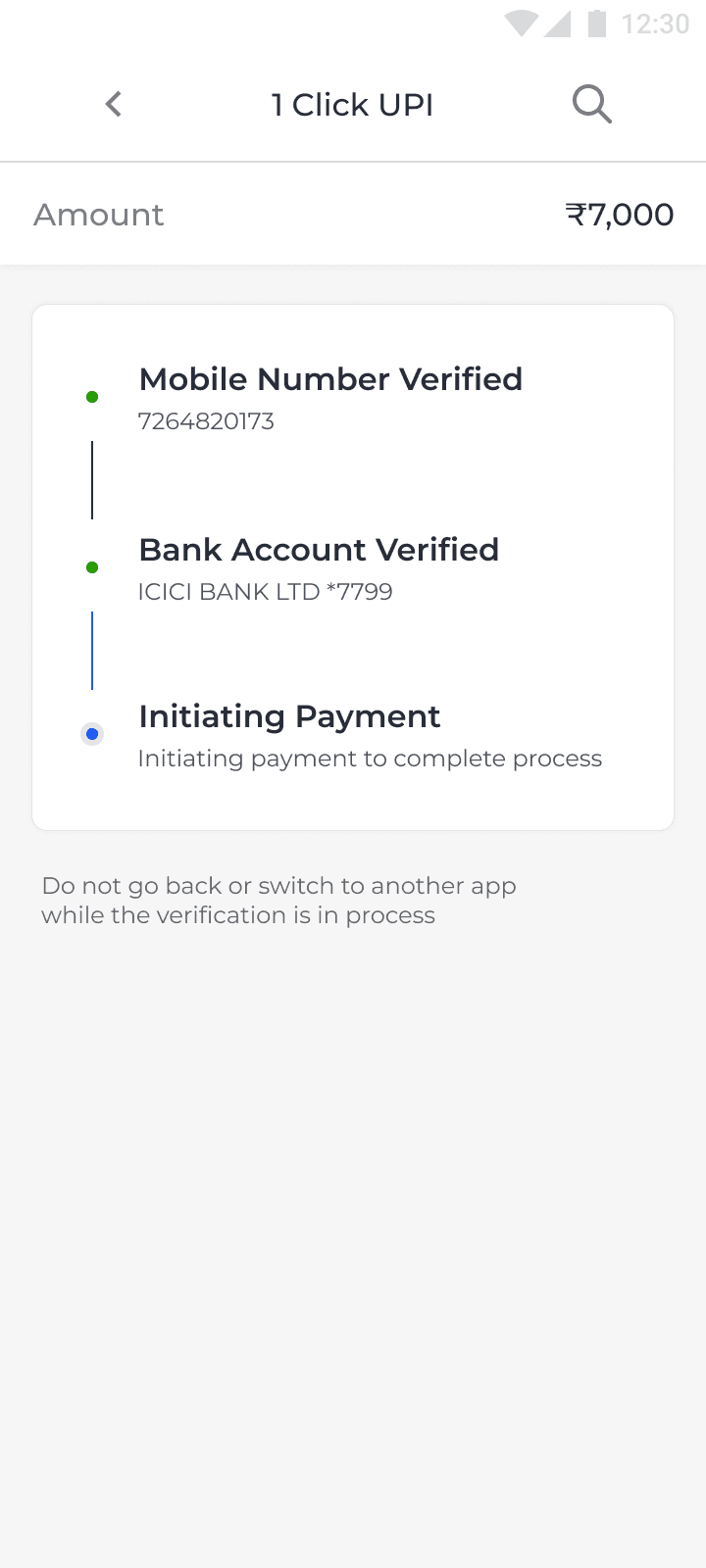

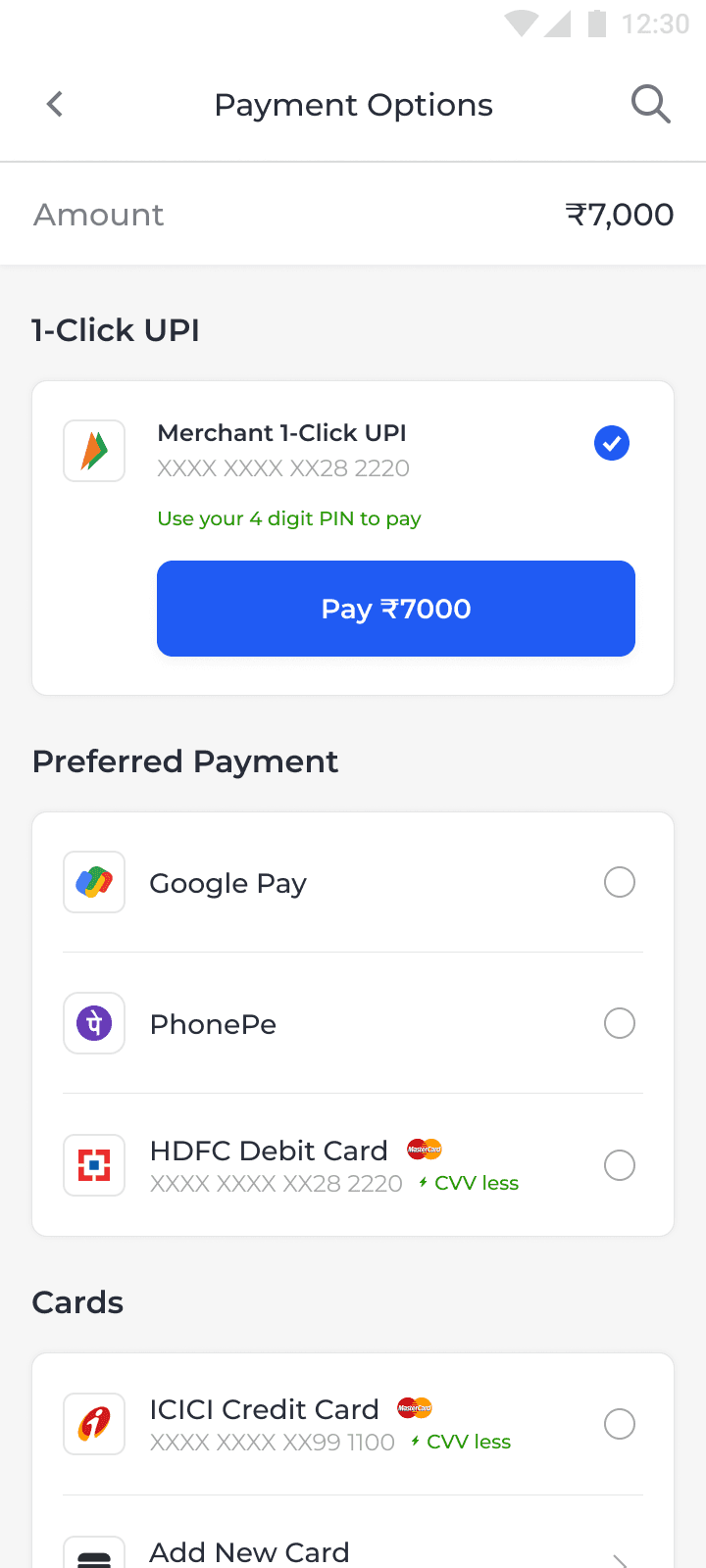

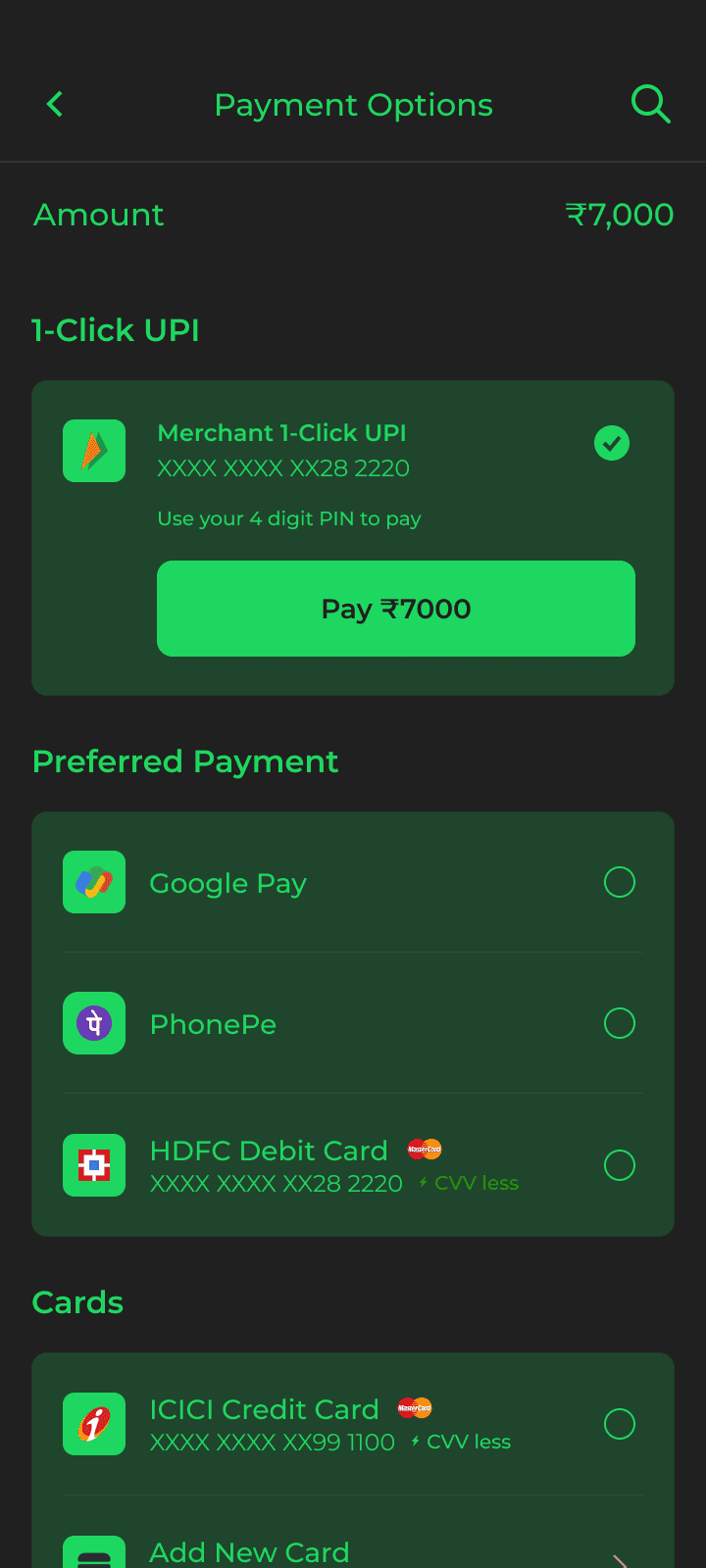

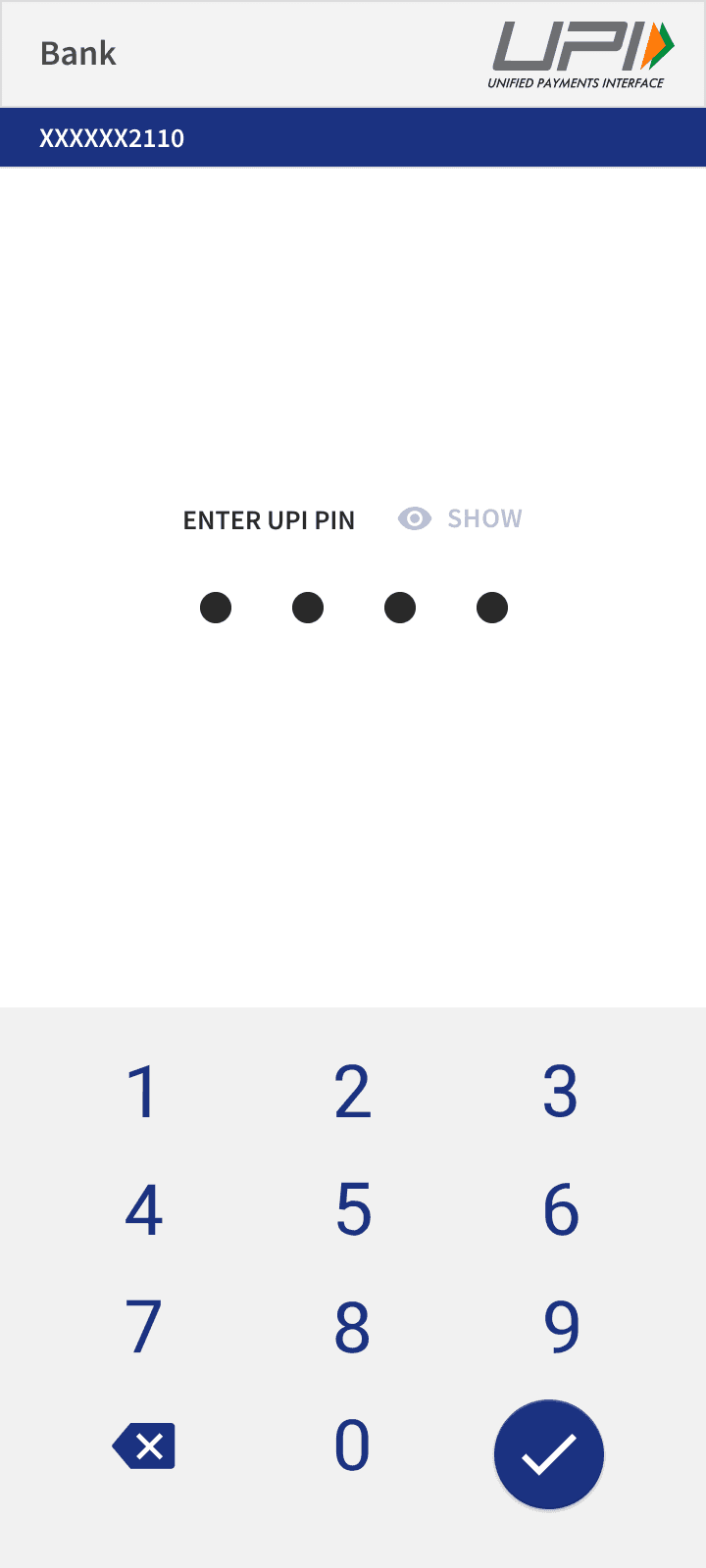

Well, the user journey for 1 Click UPI is rather simple -

For thousands of years, the most natural form of payment for humans has been cash exchange.

Cards, wallets, BPNL companies and all other forms of digital payments (while having started with more complex experiences) have strived to reach the simplicity of simple cash exchange; with 60 years in the making we have now reached a point where a user can make CVV less transactions with cards, which is essentially a 1 click payment experience.

Despite being the most popular form of payment today, even the most efficient UPI flow consists of multiple steps and comes with a learning curve for the non-tech savvy. Just like any other form of payment, our aim with 1 Click UPI is to make it as easy as the action of giving cash.

When onboarding, it’s vital that the user sees this option completely blended with the merchant’s UI, building onto the trust that the user already has on the merchant that they’re paying to.

The onboarding journey ends with the user completing the payment whilst creating a clear segue for any future payments to be a single click.

While it solves the current problems with UPI Intent, our aim is to provide an even more efficient experience for the user; the removal of putting MPIN for recurring transactions, option to switch bank accounts and more.

Once the user is onboarded, it’s easy to make any payment that occurs after onboarding

just about

5 steps, less than 5 seconds

8 steps,

20 seconds

While the Intent flow is the fastest, most optimised peer to merchant UPI flow yet; the redirection and dependence on other apps still lead to the following -

Transaction Failures

Users often encounter transaction failures during the peer-to-merchant UPI Intent flow, leading to frustration and abandonment of the payment process.

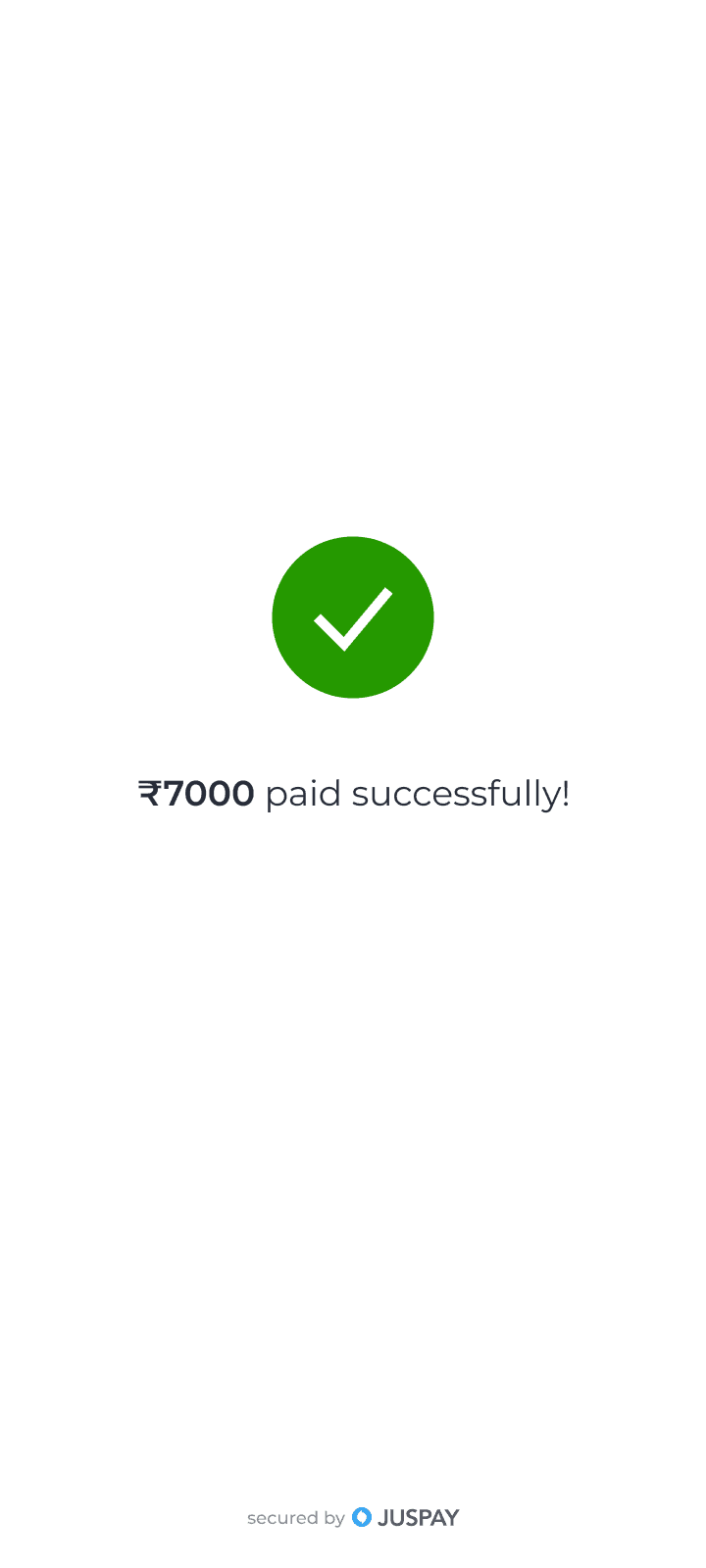

90% > Success Rate

With zero dependance on any third party app, there is complete elimination of any technical failure that is caused on the app’s end.

These problems led us to our -

Drop-offs

Merchants experience drop-offs in the current flow, where users initiate payments but fail to complete them, resulting in lost sales opportunities.

Better Control

With the insights of the user journey, merchants can understand why users drop off and help them strategise better for higher conversion.

Complexity

The current UPI Intent flow is complex for a certain set of users, requiring multiple steps or confusing instructions leading to them not adopting the same.

Ease of Use

Decreasing cognitive load on the user, the option streamlines the payment process and saves time, especially for frequent transactions.

Inconsistencies Across Platforms

Users encounter inconsistencies in the flow experience when using different platforms, causing confusion and impacting trust in the payment process.

Our Goal

“Craft a smooth peer-to-merchant UPI experience, eliminating transaction failures and drop-offs for merchants, while providing users with an effortless one-click payment experience.”

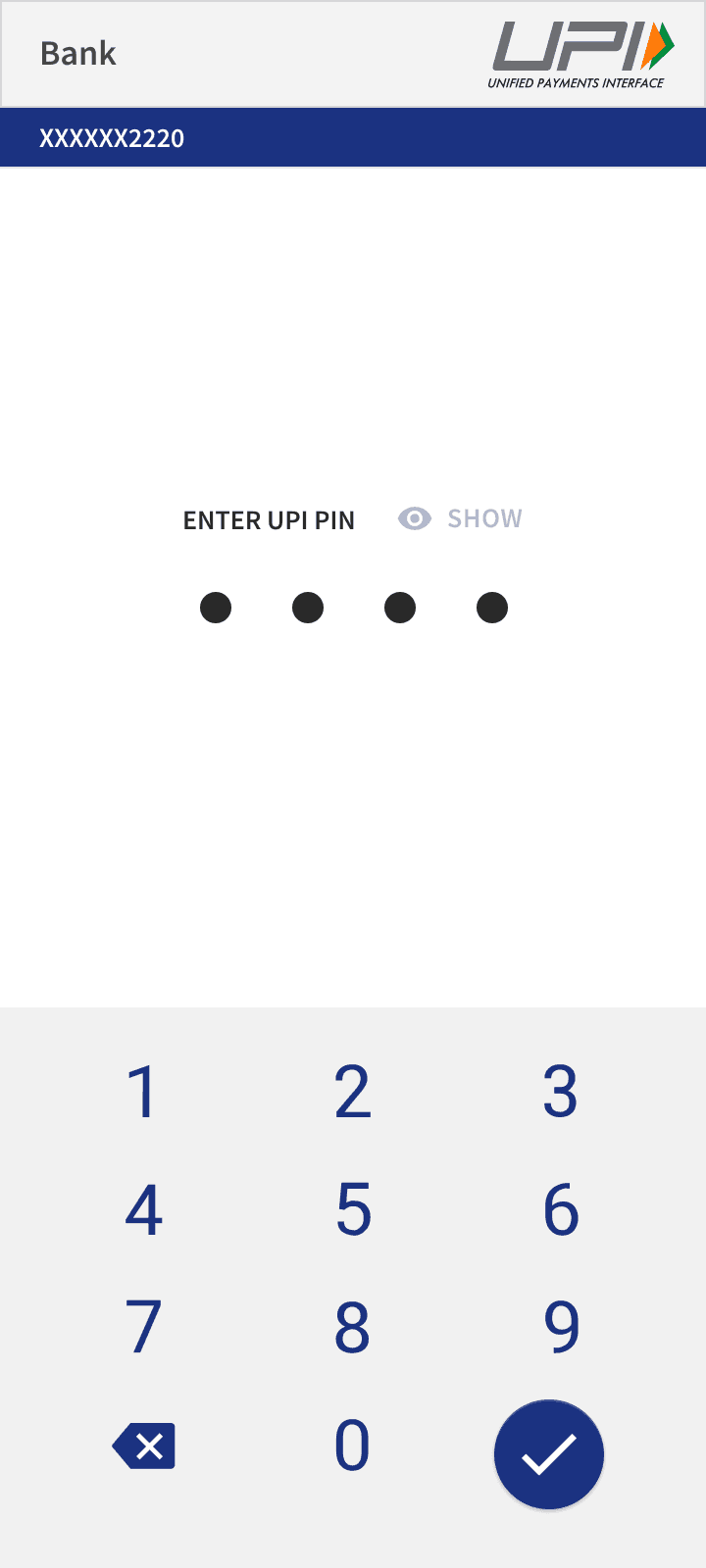

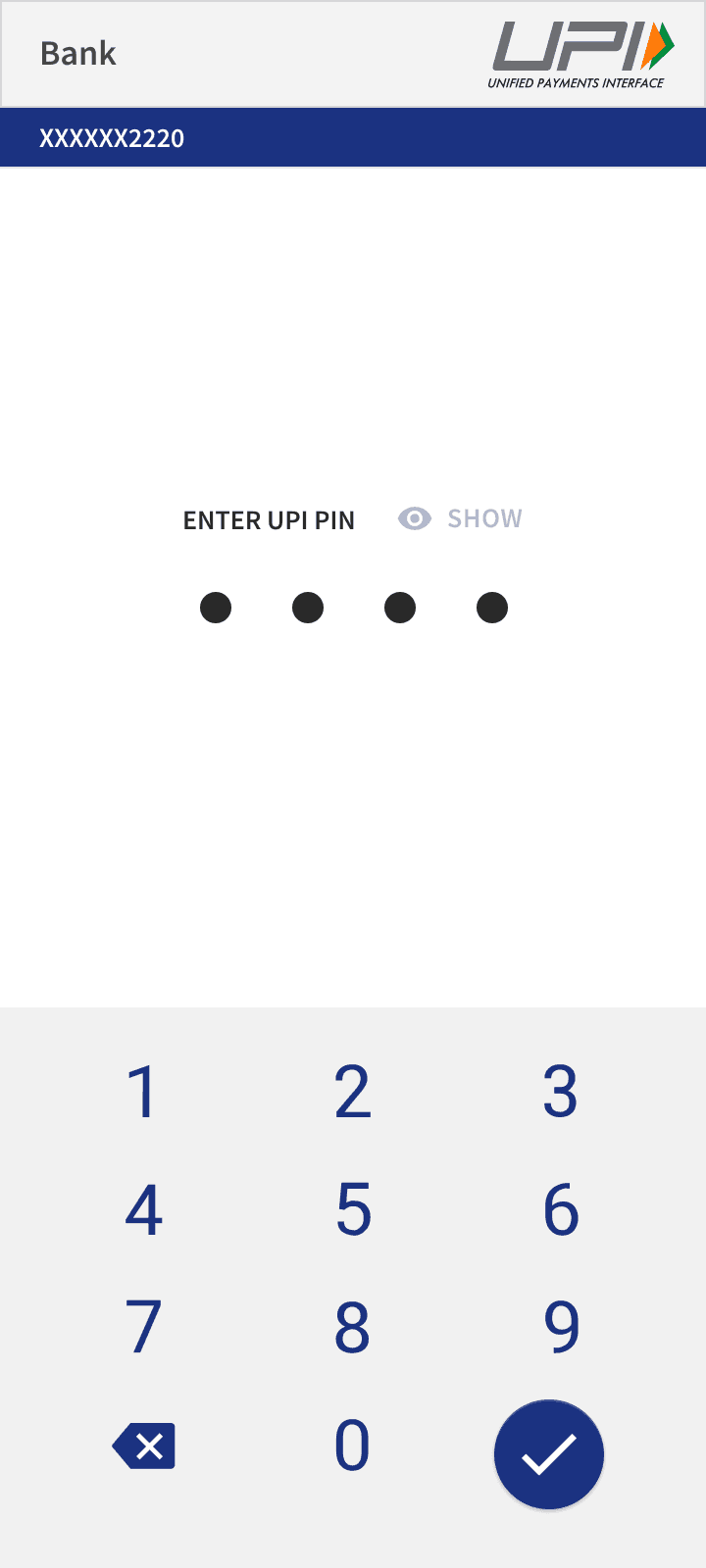

Click 1 Click UPI

on Payment Page

Enter

your MPIN

Payment

Successful